LaTisha Collier sued for eviction from her rent-to-own house

The legal and financial issues for Love During Lockup star (and Boss Tax and Accounting Services founder) LaTisha Collier continue to mount!

As we previously reported, LaTisha Collier’s Boss T&A business was evicted from their Davenport, Iowa office space featured on the show after reportedly falling behind more than $30,000 on rent and fees.

In addition to her business being evicted, LaTisha is also apparently at risk of being evicted personally!

According to court documents, LaTisha entered into a lease contract in September of 2020 on a 4,082-square-foot, four bedroom, four bath house in Davenport. This is the house featured on Love During Lockup.

LaTisha’s lease included an option to buy the property for a total of $405,000 (including a $15,000 option fee) any time before September of 2025.

To secure the option to buy, LaTisha paid $40,000 in cash up front and agreed to pay an additional $228.00 per month — all of which would be credited towards the purchase of the property if LaTisha exercised the option.

LaTisha’s landlord served LaTisha with a Notice of Forfeiture of Option Contract on November 11, 2022. The Notice claimed that LaTisha owed $13,239.00 in unpaid rent, unpaid option payments, late fees, and attorney’s fees at the time.

30 days allegedly passed without any of the money being paid, and LaTisha’s landlord filed an Affidavit of Default and Forfeiture of Option Contract that was officially recorded on January 11.

On February 3, 2023, LaTisha’s landlord filed an Original Notice and Petition for Forcible Entry and Detainer (aka eviction notice). The filing states the reason for the Notice is “failure to pay rent for current month and carrying balance of unpaid rents in violation of lease agreement.”

The case is still open with a “trial or dismiss” hearing set for September 1, 2023.

UPDATE – The case was dismissed with prejudice “pursuant to a settlement agreement” on September 1. “With prejudice” means the case cannot be filed again.

#LoveDuringLockup Inmate Keith Collier's wife LaTisha Collier is no stranger to being behind bars herself! Check out the professional financial advisor's EXTENSIVE criminal history, including multiple felony theft convictions! #LoveAfterLockup #FelonFriday https://t.co/IMnDjMmRP6

— Starcasm (@starcasm) July 21, 2023

LaTisha Collier lease-to-own details

Here are a couple excerpts from LaTisha’s lease-to-own contract:

Optionee has paid to Optioner the sum of $40,000.00 and shall also pay $228.00 on or before the 1st day of each month during the term of this Agreement commencing September 8, 2020, as consideration for granting the option to purchase, which shall be credited to the Option Price in the event Optionee exercises the option to purchase. Any excess payment shall also be credited to the Option Price. Such payments shall be made payable to [Landlord]. Optionee agrees that the option payments paid hereunder are non-refundable in the event that Optionee does not purchase the Property, and that said funds shall not be construed as a security deposit.

Optionee [LaTisha Collier] shall not be personally liable if they fail to comply with any of the following terms of this Option Agreement, however, if Optionee fails to pay any monthly option payment due hereunder, or if Optionee fails to comply with any other provision of this Agreement, or if Optionee fails to exercise the option to purchase and pay the full amount of the Option Price on or before September 8, 2025, then Optionee shall forfeit the option to purchase and all sums paid herein, in which case Optionee will no longer have the option to purchase the Property, nor have any rights, interests or claims to it. In such event, Optionor [Landlord] may record an Affidavit of Default as conclusive evidence that the option to purchase any rights of possession have been terminated.

Why lease to own a house?

If you are curious why LaTisha, who owns a financial services business, would choose to “lease to own” her house instead of buying or just renting, here are some pros, cons, and the bottom line from the Bankrate.com article “What to know about ‘lease with option to buy,’ or rent-to-own homes.”

PROS

Helps you save for a down payment over time.

Gives you time to clean up your credit before you have to apply for a loan.

Lets you become familiar with a property before you commit to buying it.

CONS

Typically requires an option fee in addition to your rent payments.

Market shifts during your rental period may affect home value.

Risk of losing money if you ultimately don’t qualify for a mortgage or decide not to purchase the property.

BOTTOM LINE

A lease-option-to-buy arrangement can be a useful solution for potential homebuyers, especially if you love a particular home but could use some extra time to save up more and increase your credit score before securing a mortgage. It’s not without its risks, though. If you think it makes sense for you, ask a real estate attorney to look over the paperwork and walk you through the agreement before signing on the dotted line.

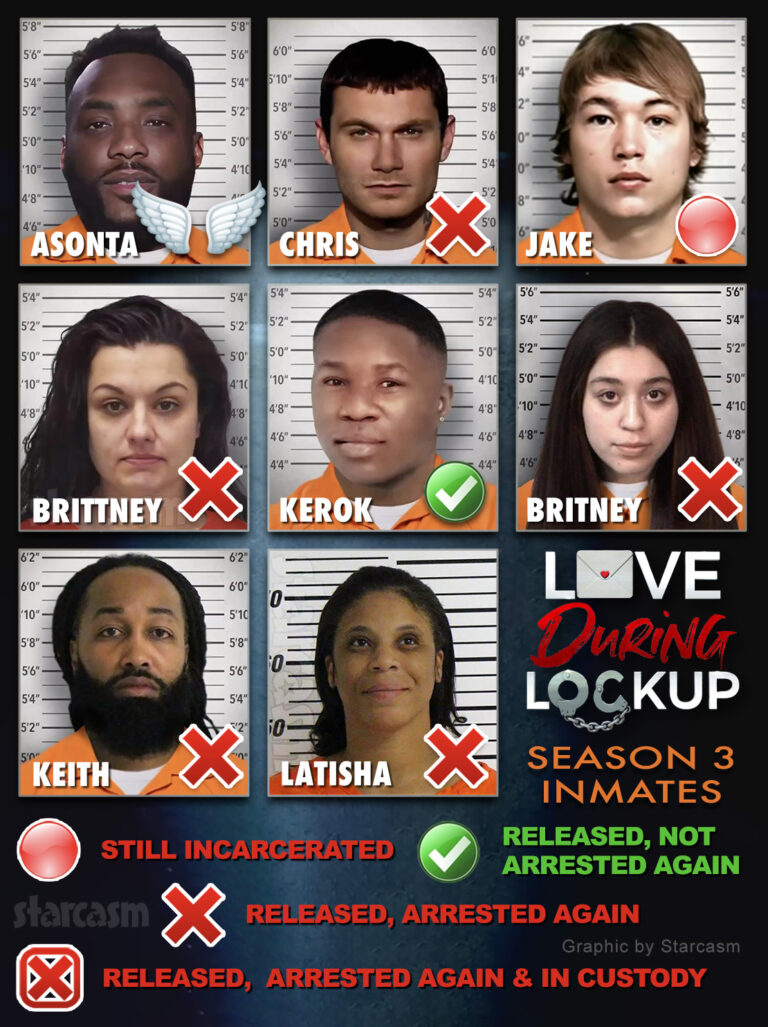

LaTisha Collier has stated that her extensive criminal history will be brought up on the show this season. It’s unclear if her financial and/or legal issues will. To find out, be sure to tune in for new episodes of Love During Lockup airing Friday nights at 9/8c on WE tv!

Asa Hawks is a writer and editor for Starcasm. You can contact Asa via Twitter, Facebook, or email at starcasmtips(at)yahoo.com