How much money did Robyn and Kody Brown make selling their Flagstaff house?

On the current season of Sister Wives, Kody Brown informs Janelle Brown that he doesn’t have the money available to pay off the last plot of Coyote Pass land. Meanwhile, Kody and Robyn put more than $400,000 down on a Flagstaff house they purchased for $2.1 million just last month!

In case you missed it, Kody and Robyn recently sold their previous Flagstaff house (affectionately dubbed Brownton Abbey) for $1,775,000. That is almost double what the couple paid for the property ($890,000) in August of 2019.

According to what the Browns have stated on the show, the entire family helped pay the $222,500 Brownton Abbey down payment. It’s unclear if there was any sort of arrangement in place for Meri and/or Janelle to be compensated once the property sold.

HOW MUCH MONEY DID KODY & ROBYN MAKE SELLING THEIR HOUSE?

Robyn and Kody Brown bought Brownton Abbey for $890,000 in 2019. They sold it for $1,775,000 in 2024. That’s a difference of $885,000 in just five years! That would mean their property value increased an average of $177,000 a year!

So, how much did Robyn and Kody actually make from buying and selling the Flagstaff house? It’s impossible to know the exact amount, but we’ve compiled as much information as we could gather for you below.

We will start with the $885,000 difference in selling prices. From that amount we will need to subtract a few costs.

It’s likely Kody and Robyn paid realtors’ fees, which generally range from 5% to 6%. Five percent of the sale price would be $88,750.

Closing costs look to average roughly 1.2% in Arizona, which comes to $21,300.

Let’s do some quick math:

$885,000 – $88,750 – $21,300 = $774,950

We will round up to $775k.

Kody and Robyn would qualify for capital gains tax exemption on $500,000. That leaves a taxable capital gain of $275,000.

The long-term federal capital gains tax for $275,000 would be 15%. That equates to $41,250 in federal capital gains tax.

(If Kody and Robyn had no other income, they would be able to subtract $94,050 from $275,000 when calculating capital gains tax. However, it is safe to assume they made more than that amount from TLC in 2024. If the couple made more than $333,750 from TLC and other sources in 2024, they were likely bumped into the 20% capital gains tax bracket.)

Arizona’s capital gains tax has the same brackets as the federal guidelines. It looks like Robyn and Kody would pay 1.875% capital gains tax on $275,000, which equals $5,156.25. (It might be that Arizona capital gains would be calculated based on the amount after federal capital gains tax, or vice versa. The difference wouldn’t be too dramatic either way.)

That’s a total of $46,406.25 in federal and state capital gains taxes. Let’s round up to $46,500.

If we subtract $46,500 from the $775,000 capital gain they got from selling the house, that leaves $728,500 cash in pocket.

However, that figure does not represent the couple’s profit because they had home owning expenses they did not get back.

Kody and Robyn have made significant improvements to the property, including the installation of a heated driveway. We will estimate the amount of improvements to be $25,000. (Please note that purchased artwork does not count towards home improvement. If that were the case, the amount would likely be close to $1 million, adding at least $1,000 to the value of the property. 😂)

Also, we can’t forget that a large chunk of monthly mortgage payments goes towards interest and not principal.

It should be noted that Kody and Robyn refinanced in 2021 when interest rates were a little lower. The new 30-year mortgage was for only $548,250, so the couple clearly paid a lot towards the principal in addition to their monthly mortgage payments.

Based on two years at the previous average interest rate and original amount, and three years at the revised average interest rate and amount, Kody and Robyn paid roughly $62,988.14 towards the principal and roughly $103,404.14 towards interest.

So, let’s take the $728,500 “profit” and subtract $103,404.14 paid toward the interest on their loan. We can also subtract the estimated $25,000 for maintenance/upgrades and the $222,500 initial down payment.

The end result would be $377,595.86 profit.

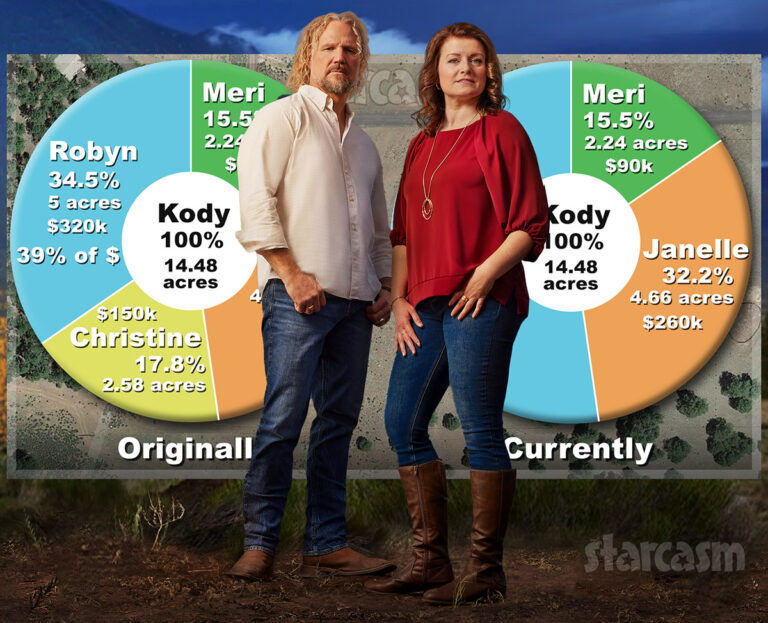

It’s also important to remember that the Browns still own all the Coyote Pass lots, and they are all fully paid off. Coyote Pass is very close to Brownton Abbey, so it is safe to assume the land value has increased dramatically since the family purchased the lots in June of 2018.

The 2025 full cash value of the Coyote Pass properties as of December, 2024 is $1,389,552. We ran the math and our estimate was a bit higher. That’s another great return considering the family paid $820,000 for all four lots in June of 2018. Especially when you consider Kody and Robyn will get half of that.

There are A LOT of reasons to criticize the Brown family for making the move from Las Vegas to Flagstaff, but it CERTAINLY worked out from a financial standpoint!

#SisterWives Curious to know all the places the Browns have lived over the years – including the very early years in Utah, Wyoming and Montana? We've gotcha covered! #EncyclopediaBrowns LINK: https://t.co/j1bo5P3XPC

— Starcasm (@starcasm) September 26, 2022

Asa Hawks is a writer and editor for Starcasm. You can contact Asa via Twitter, Facebook, or email at starcasmtips(at)yahoo.com