LaTisha Collier’s bankruptcy in ‘bad faith,’ Starcasm cited in Motion To Dismiss

LaTisha Collier’s Boss Tax and Accounting Services business is being called out for their most recent bankruptcy filing. In the Trustee’s Motion To Dismiss, the company is being accused of filing in “bad faith,” and the court documents cite multiple Starcasm articles as reference.

Scroll down to the “LaTisha bankruptcy update” header for the latest! For those who haven’t been keeping up with all the LaTishananigans, I am going to start with a relatively brief recap to set the stage.

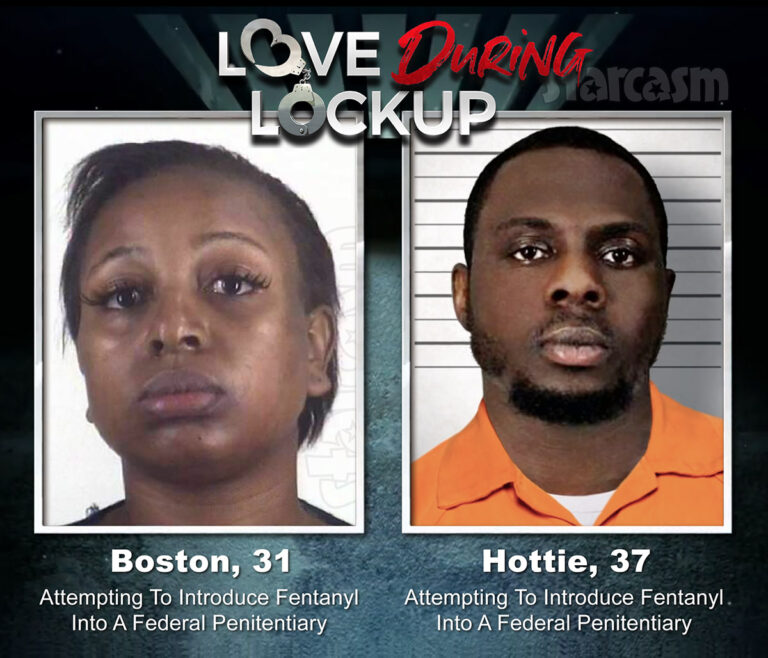

LaTisha has personally filed for bankruptcy seven times, which Starcasm did an article about in August of 2023. LaTisha’s first bankruptcy filing was with her first husband in 2009, and that was the only filing that actually went through.

The other six bankruptcies were LaTisha filing as an individual. After the Starcasm article was published, as well as our article about LaTisha’s felony convictions, she did an interview with Mary from Kiki and Kibbitz in an attempt to explain her side.

During the interview, LaTisha admitted to filing for bankruptcy in order to get an automatic stay on debt collectors. She also admitted in the interview that this is bankruptcy fraud and is illegal.

Boss Tax and Accounting Services filed for bankruptcy in September of 2022, roughly one week after the business was sued by their Davenport landlord for unpaid rent. The bankruptcy was soon dismissed because the business didn’t have legal representation (which is required for a business filing for bankruptcy) and LaTisha filed an Application To Pay Filing Fees In Installments, which is only an option for individuals.

Boss Tax and Accounting Services renegotiated their lease with much higher rent, but they were eventually evicted in July of 2023. They immediately moved their main office to another Davenport location.

The landlord at the new location sued Boss Tax and Accounting Services for unpaid rent and filed an Original Notice and Petition for Forcible Entry and Detainer on November 28.

On December 27, the judge in the eviction case signed an Order For Forcible Entry And Detainer. The Order stated a Writ of Possession would be issued on January 2, giving physical possession of the office space back to the landlord.

On the same day that the judge signed the Order For Forcible Entry And Detainer, Boss Tax and Accounting Services filed for bankruptcy again. In addition to not having an attorney (again), LaTisha also followed up with another Application To Pay Filing Fees In Installments so she could avoid paying the $1717 filing fee up front. If you recall, those were the two things that caused her previous filing to be dismissed.

On January 2, which was the day the landlord was scheduled to take the office space back, the judge granted a stay due to the bankruptcy filing.

LaTisha bankruptcy update

Whenever a person or business files for bankruptcy, the court appoints a trustee to look over the filing and assure that everything is on the up and up. As you might have guessed, the trustee for the most recent Boss Tax and Accounting Services bankruptcy filing DID NOT believe it was on the up and up. At all.

The Trustee’s Motion To Dismiss was filed on Wednesday. The Motion contains a long list of reasons why the bankruptcy should be dismissed, including the same two reasons the company’s previous bankruptcy filing was dismissed: Boss Tax and Accounting Services didn’t have an attorney (which is required for a corporate filing) and LaTisha filed a request to pay the filing fee in installments, which is not allowed for corporate filings.

The Trustee notes that LaTisha didn’t file a lot of the required documents, “including bankruptcy schedules and statements, or small business financial documents.”

Also, as we pointed out in our article, the Trustee highlighted the portion of the filing in which LaTisha checked “No” when asked “Were prior bankruptcy cases filed by or against the debtor within the last 8 years?”

(Despite the fact that the previous bankruptcy filing was dismissed, the Trustee’s Motion indicates Boss Tax and Accounting Services is still on the hook for the original $1717 filing fee. It’s unclear if the business owes another $1717 for filing again.)

“Based on the current failure to pay the filing fee in full and apparent lack of counsel, Debtor is not eligible to proceed under chapter 11,” the Trustee states. “It also appears that Debtor’s case was filed in bad faith.”

Boss Tax and Accounting Services bankruptcy in bad faith

At this point in the filing, the Trustee puts together her own recap of the financial LaTishananigans over the last 15 years:

In the present case, Debtor falsely stated on the petition it had not filed a prior bankruptcy in the last eight years.

The UST [United States Trustee] is informed, believes, and thereon alleges that Debtor’s owner, LaTisha Collier, has filed at least six prior bankruptcy cases between 2012 and 2018, in the Southern District of Iowa…The referenced cases were filed pro se, under the name LaTisha Griffin. Each case was dismissed without the receipt of a discharge.

The UST is informed, believes, and thereon alleges that Debtor filed the instant case on the same date it was ordered to remove itself from its leased premises. On December 27, 2023, an Order for Forcible Entry and Detainer was entered in an eviction action in the Iowa District Court for Scott County…The UST has further received information from a third party that LaTisha Collier, aka LaTisha Griffin, acknowledged in an online interview that she filed multiple bankruptcies to delay debt collection and acknowledged that obtaining a bankruptcy stay solely for the purpose of thwarting creditors is illegal.

The filing includes a screen cap from our article about LaTisha admitting she filed bankruptcy multiple times to stall debt collectors. The filing is cited with a link to the Starcasm article about the interview, and our article about her business’s most recent bankruptcy filing:

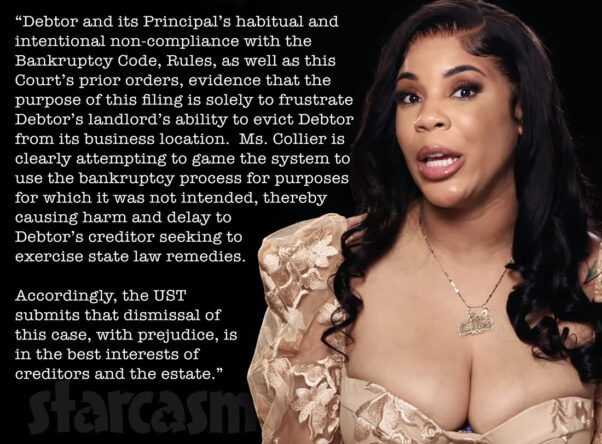

The Trustee later recaps the bad faith argument against LaTisha and Boss Tax and Accounting Services:

Additional cause to dismiss exists resulting from Debtor and its Principal’s bad faith abuse of the bankruptcy process. The circumstances surrounding the current filing and prior filings associated with Debtor and its owner are indicative that the case was filed in bad faith.

…Debtor and its Principal’s habitual and intentional non-compliance with the Bankruptcy Code, Rules, as well as this Court’s prior orders, evidence that the purpose of this filing is solely to frustrate Debtor’s landlord’s ability to evict Debtor from its business location. Ms. Collier is clearly attempting to game the system to use the bankruptcy process for purposes for which it was not intended, thereby causing harm and delay to Debtor’s creditor seeking to exercise state law remedies.

Accordingly, the UST submits that dismissal of this case, with prejudice, is in the best interests of creditors and the estate.

In addition to recommending the bankruptcy filing be dismissed, the Trustee also recommends that Boss Tax and Accounting Services be barred from filing for bankruptcy again for a while. “The UST requests the Court exercise its discretion to dismiss this case with prejudice under Section 105(a) to enjoin Debtor from future bankruptcy filings for a period certain.”

LaTisha has just 7 days to respond

At the same time that the Trustee filed her Motion To Dismiss, she also filed a motion to shorten the amount of time LaTisha was allowed to respond.

“The continuance of this case for any period is causing harm to Debtor’s creditors, specifically its landlord, and provides no benefit to the estate,” the Trustee argues. “Pursuant to Fed. R. Bankr. P. 9006(c), the UST submits there is cause to shorten the time to object to the UST’s Motion to Dismiss to a period of seven (7) days, which objection to be filed no later than Wednesday, January 17, 2024.”

It only took the bankruptcy judge in the case a few hours to issue an Order and Notice of Bar Date in support of the Trustee’s recommendation and the January 17 deadline. Hopefully this will allow the landlord to regain the property soon so they can find a tenant willing to pay rent.

It’s unclear if LaTisha plans to file a response. It’s also unclear whether or not Boss Tax and Accounting Services will be facing bankruptcy fraud charges stemming from their “bad faith” filings. LaTisha herself stated that filing bankruptcy solely to delay debt collection (or eviction) constitutes bankruptcy fraud.

Stay tuned!

UPDATE – LaTisha responded on January 17 by writing a paragraph assuring the Court that Boss Tax and Accounting Services “incurred a large debt over the past year” and she will be filing the proper paperwork soon. She requested more time to get that done.

According To Amber was the first to report on the latest development in the Boss Tax and Accounting Services bankruptcy case.

Asa Hawks is a writer and editor for Starcasm. You can contact Asa via Twitter, Facebook, or email at starcasmtips(at)yahoo.com