GameStop to enter NFT & crypto markets, stock skyrockets

GameStop stock continues its roller coaster ride this week as it is currently up more than 33 percent since Monday. The initial stock price surge was on Tuesday, the same day that it was revealed GameStop is jumping into the NFT and crypto currency markets — markets perfectly suited to the brick-and-mortar retailer’s transition to a focus on eCommerce.

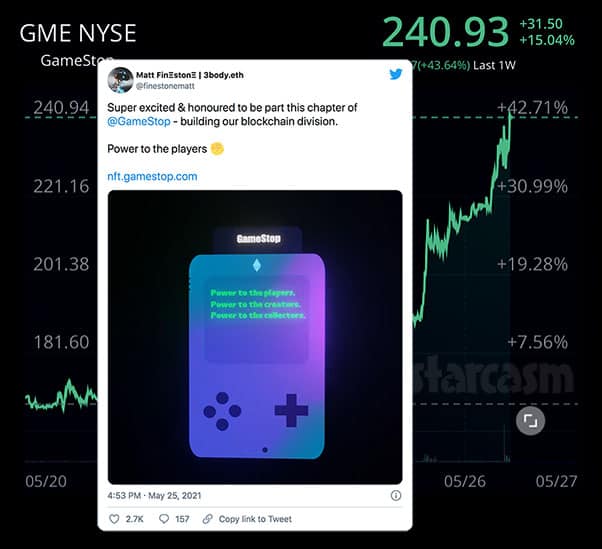

It’s unclear if GameStop intended for its venture into NFTs and crypto to be revealed on Tuesday. Online sleuths discovered that the company’s website had a special NFT page set up, including links to information about GameStop crypto. The news spread like wildfire on various forums and social media platforms. GameStop’s Head of Blockchain, Matt Finestone, later confirmed the news on Twitter.

“Super excited & honoured to be part this chapter of @GameStop – building our blockchain division,” Matt wrote. He added GameStop’s slogan “Power to the players” along with a raised fist and a link to NFT.GameStop.com.

Looking through Matt’s previous tweets, you can see his pitch to aspiring developers to join the team:

Resharing this as some folks might have come out of retirement today :).

At this gig, you will:

– Help bring millions of users onto Ethereum

– Work for a stealth startup unit within a large public corp.

– Have a salary

– Not allow a big red wick to determine your future! 🤪 https://t.co/wbrGt55lbV— Matt FinΞstonΞ | 3body.eth (@finestonematt) May 19, 2021

If you’ve been paying attention to the headlines, you probably know that this past week hasn’t exactly been the best week for crypto. And NFTs have been the hot new thing long enough to start cooling off dramatically. One of the major issues with both crypto and NFTs is that folks find it hard to imagine real world applications for either. GameStop can change that almost instantly.

There have been SO MANY posts on reddit and other gaming forums raving about all of the possible things that GameStop can do utilizing blockchain via NTFs and crypto. Here is an excerpt from a reddit post titled “We aren’t even grasping how big the NFT news is yet” by u/AJDillonsMiddleLeg:

Yeah, it’s a big deal. Remember the NFT stock craze a couple months ago? Everyone was rushing to pump out NFT news. Most of those companies haven’t actually developed any NFTs yet.

In my opinion, the biggest weakness to NFTs is a lack of utility. The most popular NFT medium was NBA Tipshot. People were literally paying tens of thousands of dollars to “own” a 10 second highlight video. A video you can go lookup and watch on YouTube whenever you want. But yeah, you own that clip I guess.

What GameStop is doing is creating utility for NFTs. We all know video games are mostly digital now, and moving more and more in that direction. We knew GameStop was going to go that way. But this?

GameStop is about to release the FIRST actual use-case for NFTs at scale. They are going to use NFTs to establish official ownership for digital copies of games. This will allow the sale of used games, and will allow GameStop to transition one of their oldest business niches to the digital world. And it will be a global, widespread use-case for NFT technology. Nobody in the world has established an actual use-case for NFTs. GameStop just did.

This doesn’t just put them on the forefront of digital gaming. This also puts them at the forefront of the NFT industry. They could become a global leader in NFTs along with being the global leader in gaming. This also gives them an edge to beat Steam to the next level of the digital gaming industry.

This is it. GameStop just became the final boss. I knew Ryan Cohen was a genius, but holy sh*t. He did it. GameStop did it. There is no beating this.

GameStop’s main business model over the past 30 years has been buying and reselling used video games. I simply cannot imagine what it would mean to be able to do that all digitally. And remember, blockchain allows for original creators to get a cut every time the property is sold. That means that video game developers will benefit hugely from this as well, which is something that wasn’t the case when buying and reselling hard copies of games. It’s a win/win situation that is going to make it VERY easy for GameStop to work out partnerships to help promote their marketplace.

On the NFT.GameStop.com page, you can find a rather lengthy combination of numbers and letters with a button for copying it. If you paste that into Google, you will be taken to the Ethereum platform Etherscan. From there you can follow the GME token trail until you find a field for “Launch Date.” In that field is the number 1626261600, which is a Unix epoch timestamp that equates to July 14, 2021. (It actually narrows it down to 11:20:00 AM GMT.)

Gamestop’s venture into NFTs and crypto is just one aspect of their transition that we are aware of. Despite GameStop remaining in the headlines for the past five months, chairman-elect Ryan Cohen has remained essentially silent about the changes that the company is currently undergoing in it’s transition from a traditional brick-and-mortar retailer to a business focused more on eCommerce. (Photos have surfaced online of some GameStop locations being converted into eSports facilities for players, so clearly that looks to be a potential focus.)

The stage seemed to be set for Ryan Cohen to finally break his silence at the GameStop shareholders meeting scheduled for June 9. The former Chewy biz wiz will officially become chair, and the completely revamped board of directors will officially be put in place. (I’m imagining a Steve Jobs-like event with elaborate theatrics, but that might be a stretch.) I’m wondering if perhaps the NFT and crypto reveal wasn’t supposed to happen until the shareholders meeting, and it got discovered early. That’s purely speculation however.

The main point is that I think there are going to be numerous game-changing announcement from Ryan Cohen on June 9 as he shares specifics about how GameStop is already becoming something completely new. The rumor that GameStop might be buying Super League Gaming is just one example. Remember, Cohen orchestrated a 3.5 million share sell off in April that has given the company more than $550 million in cash to work with. It’s hard to believe that the video gaming industry hasn’t had the equivalent of Amazon or Netflix in regards to eCommerce, but that is clearly about to change.

Why did GameStop stock go up?

So, now we know why GameStop stock shot up this week, right? Absolutely not! GameStop’s stock surge — at least on Tuesday — looks completely divorced from the NFT and crypto reveal. The clearest evidence that this is the case is the ongoing marriage between the stock movement of GameStop and other “meme” stocks that were heavily shorted at the end of last year.

The two most obvious examples are AMC and Koss. While GameStop stock movement tends to have no correlation to the market overall, it is closely mirrored by these two stocks — which are completely different companies in completely different industries. The mirroring continued on Tuesday as AMC was up 20 percent and Koss was up 23 percent.

Why in the world would the stock of seemingly unrelated companies be tied together like this? There are lots of theories on forums like reddit’s r/suprtstock. Most all of the theories are tied to the notion that hedge funds didn’t cover their short positions earlier this year, and they are currently hiding that fact with shady tactics. However, those tactics can only go on so long before they will have to cover. (If you’ve been paying attention to the financial world, the SEC, DTCC, NSCC and other regulatory organizations have been passing numerous new rules and regulations pertaining to tracking shady trading and limiting the damage from over-leveraged institutions.)

These kinds of theories may seem like Q-Anon level tin foil hattery to some, but there are a growing number of heavy hitting experts in the world of financial corruption that are verifying that the tactics being theorized are not only possible, but have been used for decades. (And there are billions of dollars in SEC fines to prove it.) That doesn’t mean that GameStop is still shorted to some mind-blowing extent, but it does mean that it is entirely possible. Perhaps the fundamental problem is that we really have no way of knowing.

So why did/is the GameStop stock price jumping this week? One theory is that some of the delay tactics being used by hedge funds require cyclical stock purchases in order to continue kicking the can down the road. That theory seems to be gaining a lot of momentum thanks to more and more predictions coming true.

Reddit’s u/ihatedmyboss posted back in late March proposing a theory that GameStop (and some other) stocks were spiking up in intervals that were 21 trading days apart. OP didn’t know why this was happening, just that the pattern was there in the numbers. The explanation that seems to make the most sense is that the spikes are covering failure to delivers that are required to be covered within 21 trading days.

Regardless of the reasoning, u/ihatedmyboss was able to use the stock history to predict a large spike on May 25 that would carry over to May 26. Here’s a link to the full post for those of you curious about the specific numbers:

For those of you wanting to join the GameStop ape army, here’s a post to help you get caught up on the research they’ve done into the potential manipulation of the stock and the theory that the “mother of all short squeezes” (MOASS) is yet to come.

NOTE: I have been a diamond-handed ape (aka GameStop shareholder) since March.

At the time of this post, GME stock is up to $240.93 per share. That is a 15 percent increase over Tuesday’s closing price of $209.43, and a 33.8 percent increase over Monday’s closing price of $180.01.

Asa Hawks is a writer and editor for Starcasm. You can contact Asa via Twitter, Facebook, or email at starcasmtips(at)yahoo.com